Table of Contents

Introduction of WARREN BUFFETT DEAD SQUIRREL

The mention of Warren Buffett referred to as The Oracle of Omaha, is linked to one preoccupied with money, investments, or value investing. This doesn’t sound more normal than it can be, but hopefully, it tries to teach you providential reason. These are indeed some very colorful incidents that most people like to dismiss, although this is quite a consistent image of some principles that will shape your growth in the investment. It is funny why anybody will want to learn from a stuffed rat, not to say look for a relationship between how this stuffed rat is feted for its investments.

However, some lessons would have to set in and not come out immediately; thus, they would need mediation. Stick with us as we find what lessons can be drawn from the Warne Buffett and Dead Squirrel article- and, more importantly, how these lessons can be instrumental in your investments.

Enhance Customer Experience for Repeat Business

Enhancing the customer experience is an aspect that more businesses should explore if they hope to thrive. Regarding the intoxication of buyers’ psychology, Warren Buffet believes that without satisfied customers, there can never be repeat business. They always spend the money earned from business/sales on loyal customers, which results in monotonous revenue generation and acts as an able marketing department.

By emphasizing effective delivery, you beat your competition. This could encompass excellent welcomes and pleasant interactions or rapid responses to requests for assistance. More training for your personnel can evoke more efforts toward creating memories for your clients, making it possible for them to return.

Further, soliciting feedback enables firms to improve and evolve uninterruptedly. Understanding what a target audience finds engaging in a product assists in revising the product for improvement in the future. If clients’ input is given due regard, loyalty is enhanced.

Obtaining new clientele is tricky and more expensive than keeping those already there. Maslow’s theory postulates that if the clients are dissatisfied with the product, the stakeholder’s wealth will not develop over time.

Introduction to Warren Buffett and His Investment Philosophy

The Master of Investment is usually agreed to be Warren Buffet, whose name is perhaps better recognized than any other for its material implications, even by the business novice. One must concede that there was such a moment for her, and it was not a significant wait.

He was quite an uproar who also liked getting himself into jumbles full of numbers since childhood. Hence, he’s most often referred to as one of the greatest investors of all time, and his rather abominable simple strategy and approach explain him.

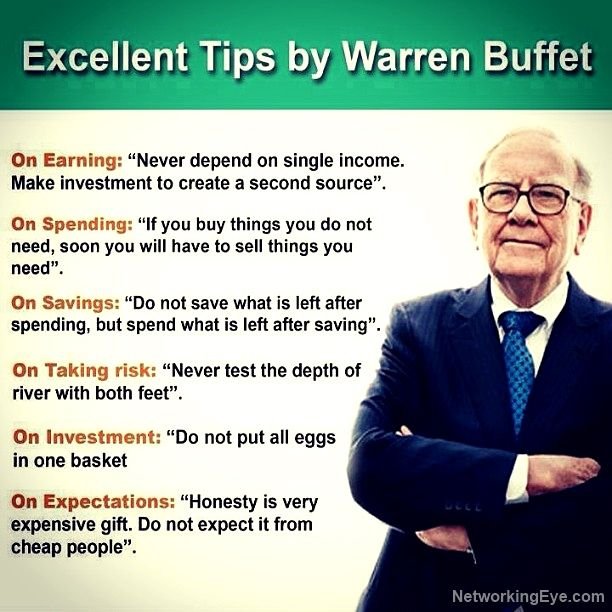

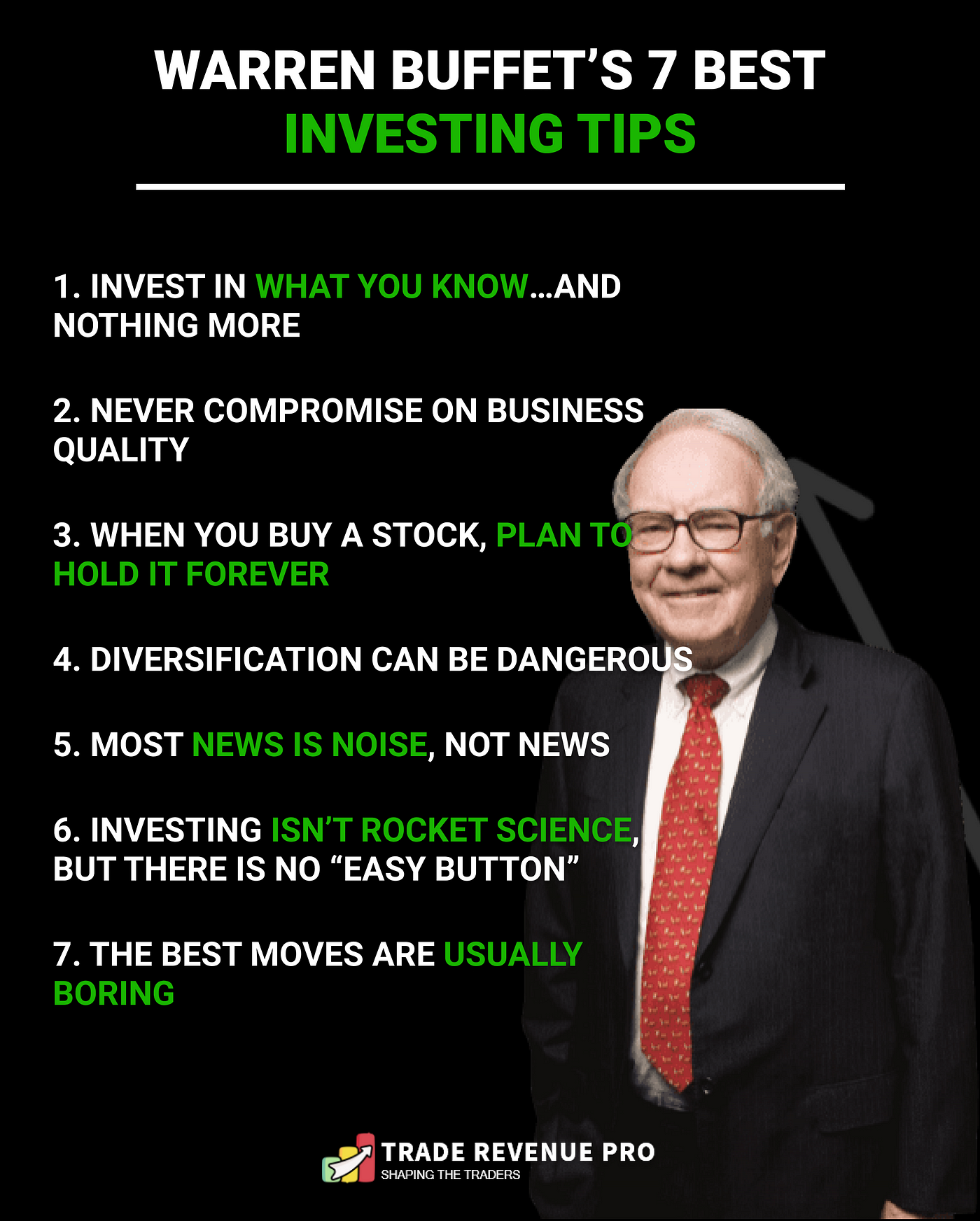

The values investment approach is supported by concentrating on out-of-favour stocks that trade at a discount. He also advises patience in investment, as matters of the stock market are matters of emotion, where the clouds can be weathered. This allows managers to make capital outlays and recover them due to the future time value of money.

Another pillar of his strategy is comprehending a business inside out before committing funds. He would instead quote that one should target only those businesses where one knows and understands what the company does. This principle has saved him for decades, during which he has achieved a lot in terms of investments.

Equity attracts Buffett because other factors include ethical management teams and sustainable competitive advantages, which are critical for vertical growth and profitable growth over business cycles.

The Story Behind the

The incident depicts what once happened on a perfect summer day in Omaha. Warren Edward Buffett, the oracle of Omaha, wasn’t too shocked to see something odd. Since childhood, he has had unusual sights—the picture of a dead squirrel by the side of the road.

This was not merely an event that happened on the day; it caused a thought process for appreciating value, which cannot be enjoyed alone in numbers. The image of the squirrel turned into an image of neglected dreams and decent concepts that offered better designs than what had been achieved.

Therefore, he began to pay attention to the animal and what was happening around it. This raises the question of what people seemed to learn about people from this sad occurrence. How often do we come across beautiful objects and dismiss them as trash because they are not what we are looking for now?

In that short period, he understood something about changing periods by changing life into death, which was the same in that one extreme change makes investments flourish and fall in the middle of perception. This interaction, which initially seemed trivial, would stick to his investment philosophy even many years later.

Lessons on Value Investing from the Dead Squirrel

The story about the dead squirrel contains many gems of wisdom, which is usually an exciting point in Warren Buffet’s investment narrative. At first, it may seem inconsequential, but it is crucial to intelligent investors.

How does this unexpected event emphasize the need for maximum research? Before making decisions, investors have to dig deep into a company’s fundamentals, just like one would want to know why a squirrel got killed.

Then, there is the issue of resilience. The universe may be filled with the unpredictable, and so are markets. A dead squirrel, by all means, aids us in comprehending the reality in which surprises are standard, and we can’t abandon our strategies due to the first hurdle.

Consider community perception. What Boffets does is understand the value of something ignored by the rest. This demonstrates a critical aspect of creating value: this is where market sentiment and public opinion should be placed with valuation techniques.

These are the lessons people aspiring to become investors need to appreciate: Under the sands, many small things to the naked eye but helpful for the whole argument become ‘fishing’, akin to the story about the dead squirrel’s virtues of narrative.

Applying These Lessons to Your Investments

When considering the lessons from the Warren Buffett dead squirrel story, consider what truly matters in your investment journey. Focus on intrinsic value instead of market trends. Identify businesses with solid fundamentals, just as Buffett looks for companies that can withstand economic fluctuations.

Next, don’t shy away from unconventional insights. The quirky tale reminds us to observe beyond surface appearances. Sometimes, hidden opportunities lie beneath an unassuming exterior.

Additionally, cultivate patience and long-term vision. Just like nature takes time to heal after unexpected events, wealth accumulates through intelligent investing choices.

Prioritize customer experience in any business you invest in. Companies that understand their customers often earn loyalty and repeat business, essential for sustained growth and profitability.

Other Times Warren Buffett Has Demonstrated His Value Investing Principles

The critical aspects of Warren Buffet’s value investing techniques feature in many big-name investment ventures. An excellent case in point is his investment in Coca-Cola. In the late 1980s, he saw that it had a strong brand and room for a lot of development, so he decided to invest a billion dollars. The company did not disappoint; it prospered, as did his investment.

A more recent and impressive event was his purchase of GEICO. Instead of backing away from a losing insurance firm, Buffett pinpointed hidden worth where others overlooked it. He successfully integrated GEICO’s market position and management into Berkshire, making GEICO a significant part of America’s largest holding company.

Buffett has by no means been a buy-and-hold investor with a selective sense of letting go of this stock rather than the other. He has shown patience with some core holdings, like American Express. When the markets went down, he did not let go of companies that he believed would do well, and in fact, he was right.

These examples reaffirm his belief in the fundamentals of constructing long-term wealth: strong brands, sound management, and a sustainable moat.

Conclusion: Why the Dead Squirrel Incident is More Than Just a Funny Story

The episode of The Dead Snug serves as an interesting analytical framework for understanding and appreciating Warren Buffett’s ideas about investing. While it can be considered funny from its context, this event contains valuable lessons about investing that are often forgotten in the excitement of new, captivating ideas.

Buffett’s style involves looking internally, valuing a business, and acting after extensive research. This story brings us back to the essential point, first and foremost: Keep sight of the critical thing: investing in well-managed companies with sound business stability from the wild in fluid situations for any of these varieties of markets.

Furthermore, improving customer experience is imperative for any business that wants to stay in business and keep customers coming back; this objective also runs through Buffett’s investments. However, such days seem to be over, and the focus shifts to foraying strategically and embracing the cynosure without shunning risks.

So, the story of the dead squirrel is more than just a funny story; it becomes a lesson that embodies the principles of Buffett’s teachings. By modifying one’s behavior concerning these rules, it may be possible to make more reasonable investment decisions and enjoy more profitable results over time, demonstrating that even the most insignificant happenings can be of great importance in one’s investment course.

FAQs

In his investment style, how does the famous WARREN BUFFETT DEAD SQUIRREL story fit in?

In the WARREN BUFFETT DEAD SQUIRREL story, opportunity management, seeking overlooked opportunities, and chasing after the mundane seem to involve much more than simple eye contact.

What can be done about the shortcoming illustrated by the WARREN BUFFETT DEAD SQUIRREL story regarding my investment practice?

The main thrusts one can borrow from the WARREN BUFFETT DEAD SQUIRREL would include intrinsic value on borrowed time in a more secular orientation and details of the investments while waiting for out-of-sight opportunities to surface.

What are the lessons from the story’s WARREN BUFFETT DEAD SQUIRREL version?

The WARREN BUFFETT DEAD SQUIRREL is more concerned with getting the most bang for the buck, such as due diligence, than being calm in adverse markets/public opinion in his dealings.

How do the investors feel about the WARREN BUFFETT DEAD SQUIRREL incident?

The investors feel the incident because it clarifies what changes in one’s investment approach are needed to achieve the requirements.

What role can the WARREN BUFFETT DEAD SQUIRREL play in customer experience in marketing management?

While the WARREN BUFFETT DEAD SQUIRREL focuses on customer satisfaction retention and customer loyalty enhancement, the anecdote’s tail end also explains Buffett’s philosophy regarding investments.

How shall the story of WARREN BUFFETT DEAD SQUIRREL be taught to a beginner?

New investors will look at the illustrated photograph of the story of WARREN BUFFETT DEAD SQUIRREL, zooming in on the stock phrases, and these will be useful in making up their minds.

How do the readers perceive the resilient traits of investors from WARREN BUFFETT DEAD SQUIRREL?

The reader learns from the WARREN BUFFETT DEAD SQUIRREL case that investors must be more patient and resilient regarding the patience-centered strategy. Stripper that we have made out last even during stormy weather.

How does the WARREN BUFFETT DEAD SQUIRREL talk about the research problem?

The WARREN BUFFETT DEAD SQUIRREL states that an investor ought to be curious and research the basics of the business. For example, I wanted to know about that squirrel, too.

Having read the story of the WARREN BUFFETT DEAD SQUIRREL, I wondered how an investor would expect to take risks.

In the words of WARREN BUFFETT DEAD SQUIRREL, the investor can appreciate both the return on investments and investment risks. Why must investment go alongside patience to reap the desired returns?

At first, I thought the WARREN BUFFETT DEAD SQUIRREL was a lovely way of addressing all the multifaceted approaches to investing.

Is the WARREN BUFFETT DEAD SQUIRREL a humorous take on profound investment lessons?

Yes, the WARREN BUFFETT DEAD SQUIRREL is a good way—where ‘good’ means funny in the particular context—to come to terms with all those heavyweight investment strategic and theoretical approaches.